Impact of a Good CIBIL Score on Two Wheeler Loan

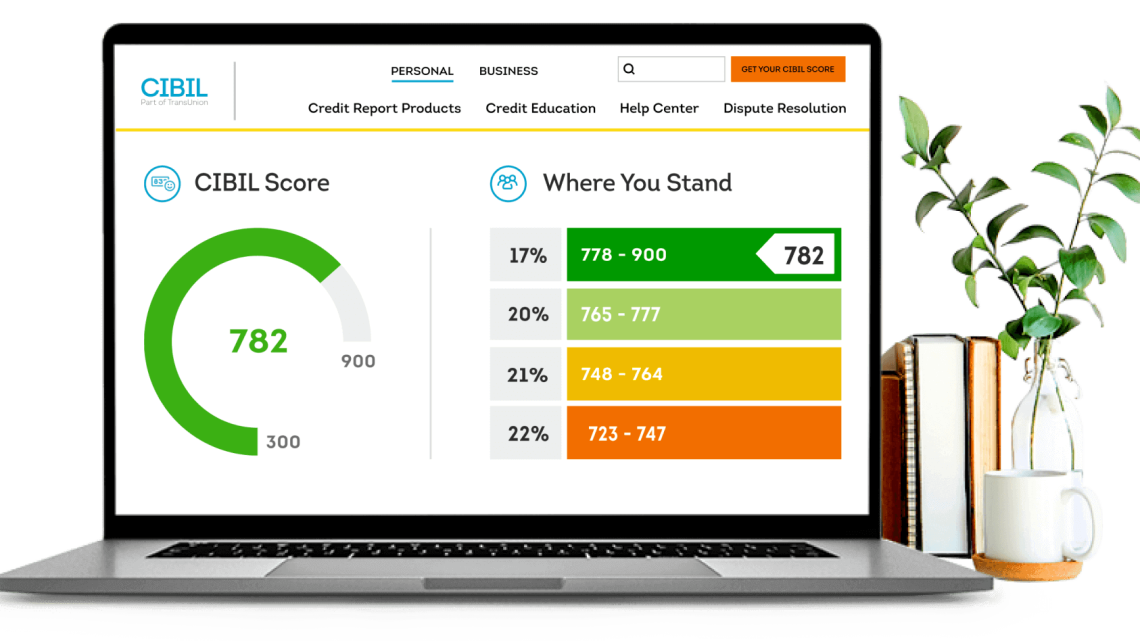

April 1, 2022Remember the good, golden days of school, where numbers used to reflect your performance during the academic year. Numbers play a significant role in decision-making. If you apply for a two-wheeler loan, will a bank provide you with the finance? The lender does not know you. Here CIBIL score comes into play. Simply stating, CIBIL is your financial character displayed through numbers. Here are a few facts to help you know how CIBIL impacts your two-wheeler loan.

What is CIBIL?

The Credit Information Bureau India Limited is an organisation that retains precious information relating to the credit worthiness of every individual who has taken a loan or credit card. On a periodic basis, the banking partners provide the information to the bureau to build the credit profile.

Any lender may check your credit worthiness in a few clicks. Bankers hold public money, and hence, CIBIL helps to increase the transparency in the lending process to the public. Credit worthiness is now a public affair. CIBIL has helped many lenders to save on providing bad loans.

How does a good CIBIL score impact your two-wheeler loan?

Interest rate:

Two-wheeler interest rates become cheaper for a person with a higher CIBIL score. The most significant benefit you would get is a lower interest rate for your two-wheeler loan.

Tenure:

Lenders may offer more flexibility in the tenure of a loan based on your higher CIBIL score. The flexible term helps you choose and switch the payments as per your choice. It further allows you to plan better.

EMI:

With lower two-wheeler loan interest rates, the pain of your monthly outgo reduces. Even a 0.25% lowering of interest rate may significantly affect your EMI. You may check your repaying capacity using the two-wheeler loan EMI calculator.

Linked offers:

Lenders provide more credit card offers to those with a higher credit score. Since repayment assurance is already established through the score, the lender tries to grab your credit profile more. This would benefit you to enjoy credit-linked offers such as huge discounts, cashback and many more.

Quick approval:

Loan approval takes time if the lender is still evaluating your credit profile. However, getting a two-wheeler loan may become easier if you have a good score.

How to obtain an ideal CIBIL Score for a two-wheeler loan?

Generally, a credit score of 750 or above is considered trustworthy. Bankers will flood your SMS box with loads of offers and discounts. However, if you are facing through a bad CIBIL score, here are some quick tips:

- Reduce usage of your credit cards to 30% of the credit limit. Exhausting the credit limit shows you as a credit hungry person. Control your expense buds for a few months.

- Do not delay paying your credit card bill. However, if you have financial crunches, at least pay the minimum bill amount. It will help you keep out of bad credit figures and rest you should manage to pay the balance bill amount as soon as possible.

- Missing the payments for any debt or credit card loan is the worst financial mistake. It displays your complete inability to honour the liabilities on time.

- If a bank rejects you for a credit card or a loan, avoid reapplying in the same bank. Watch your credit score first, and then act accordingly. Avoid going for repeated credit applications.

- Check your repaying capacity using the two-wheeler loan EMI calculator. Choose the loan amount you can honour easily and start re-building the profile slowly and steadily.

Conclusion:

CIBIL is the financial character that helps financial institutions decide on your eligibility for a loan. Hence, it is also considered the primary criterion for granting a two-wheeler loan. It may happen that your economic status may have improved, but the credit score is still displaying a bad profile. Take a pause, apply for smaller loans that can be easily approved and rebuild your profile.

Book of Dead была впервые выпущена в январе 2014 года и является одним из самых популярных онлайн-слотов для игроков из Великобритании. Play`n Go проделали отличную работу, создав эту приключенческую игру. Персонаж, похожий на Индиану Джонс, по имени Рич Уайльд, отправляется с миссией в Египет, чтобы найти древние артефакты, как и в Pearls of India. https://book-dead-slot.com Охота за сокровищами началась, отправляйтесь в путь и наживайтесь по-крупному на этом высоковолатильном слоте.

very nice website with good content.will sure visit again. Thanks

GOOD VARITETY OF TOPICS ON YOUR WEBSITE. GREAT WORK

Content different from others. Very informative article. Will surely explore again. Thanks .

nice websit. Very informative article. Will surely explore again. Thanks .

great content on your website .thanks

interesting content. thanks for sharing

very good website with good information. thanks

Getting started with Diamond 247 is simple and straightforward. To begin, you’ll need to create an account on their website. This process only takes a few minutes and requires some basic personal information.Once your account is set up, it’s time to explore the various features and options available to you.

If you wish for to improve your familiarity just keep visiting this web page and

be updated with the hottest news posted here.

Hello there! Quick question that’s totally off topic.

Do you know how to make your site mobile friendly? My web site looks

weird when viewing from my iphone4. I’m trying to find a theme

or plugin that might be able to correct this problem. If you have any recommendations, please share.

Cheers!

I have read so many posts on the topic of the blogger lovers however this post is actually a nice piece of writing,

keep it up.

Fantastic items from you, man. I’ve be aware your stuff prior to

and you’re just extremely fantastic. I actually like what you have bought right here,

really like what you are stating and the best way during which you are saying it.

You make it entertaining and you continue to take care of to stay it sensible.

I cant wait to learn much more from you. This is really a wonderful

web site.

My family members all the time say that I am killing my time here at

net, but I know I am getting experience all the

time by reading such fastidious articles or reviews.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/sv/register?ref=OMM3XK51

May I simply say what a relief to uncover a person that genuinely knows what they are discussing

over the internet. You certainly understand how to bring a problem to light

and make it important. More people ought to read this and understand this side of your story.

I was surprised that you are not more popular given that you certainly have the gift.

Aw, this was an extremely good post. Taking the time and actual

effort to produce a top notch article… but what can I say… I procrastinate a

lot and don’t seem to get nearly anything done.

By taking advantage of these deals, you can save money whbile

still getting acceszs to all of the tools and features youu need to succeed.

How to buy bitcoin https://exchange.switchcoin.us

Title: “Navigating the World of Cryptocurrency with

Exchange.Switchcoin.us: Your Trusted Crypto-Fiat Gateway”

In an ever-evolving digital economy, the allure of

cryptocurrencies, especially Bitcoin, has piqued the interest of

investors worldwide. Exchange.Switchcoin.us emerges as a

pivotal platform for both seasoned traders and newcomers looking

to delve into the realm of digital assets. This article will guide you

through the process of purchasing Bitcoin, understanding its price

fluctuations, and managing your investments through a secure

crypto wallet on a reliable crypto exchange.

Understanding Bitcoin and Its Value

Bitcoin, the first decentralized digital currency, has become

synonymous with cryptocurrency. If you’re asking yourself,

“How

much is one bitcoin?” know that its price is determined by various

factors, including market demand, investor sentiment, and global

economic shifts. The Bitcoin price is dynamic,

reflecting the

constantly changing landscape of the cryptocurrency market.

The Convenience of Buying Bitcoin on Exchange.Switchcoin.us

For those wondering how to buy bitcoin, Exchange.Switchcoin.us

simplifies the process. Our user-friendly platform ensures that

buying bitcoin is accessible and straightforward for

everyone.

With just a few clicks, users can convert their fiat

currency into

Bitcoin and embark on their cryptocurrency investment journey.

Securing Your Investment with a Crypto Wallet

A crypto wallet is an essential tool for anyone participating in the

cryptocurrency market. It allows you to securely store, send, and

receive digital currencies. Exchange.Switchcoin.us provides users

with a robust crypto wallet solution, ensuring that your Bitcoin and

other cryptocurrencies are safeguarded against unauthorized

access and cyber threats.

Why Choose Exchange.Switchcoin.us as Your Crypto Exchange?

As a crypto exchange, Exchange.Switchcoin.us stands out for its

commitment to security, ease of use, and customer support.

Whether you’re looking to buy bitcoin or explore other

cryptocurrencies, our platform offers a seamless exchange

experience. We provide real-time Bitcoin price

updates, making it

easier for users to make informed trading decisions.

Navigating the Crypto Exchange Process

The process of exchanging fiat currency for cryptocurrency can

seem daunting to novices. However, Exchange.Switchcoin.us

streamlines this process, demystifying the steps required

to buy

bitcoin. Our platform guides you through each stage, from setting

up your account and crypto wallet to executing your

first

purchase.

Maximizing Your Crypto Exchange Experience

Exchange.Switchcoin.us not only offers the tools to buy bitcoin

but also provides resources to educate users on the nuances of

the cryptocurrency market. By staying informed about Bitcoin

prices and market trends, investors can better strategize their

trades and optimize their portfolios.

Conclusion

Exchange.Switchcoin.us is dedicated to providing a trustworthy

and efficient crypto-fiat exchange service. Our platform is

designed to meet the needs of all users, from those taking their

first step into cryptocurrencies to seasoned investors diversifying

their portfolios. With our robust security measures, intuitive

interface, and real-time market insights, users can confidently

navigate the cryptocurrency landscape.

For those ready to explore the potential of Bitcoin and other digital

assets, Exchange.Switchcoin.us is your gateway to a world of

possibilities. Join us today and take control of your financial future

in the cryptocurrency space.

Hey very nice blog!

Is there a better way to quickly locate a mobile phone without being discovered by them? https://www.mycellspy.com/tutorials/how-to-locate-the-other-party-location-by-camera/

GSA has feature tha makes unique articles, then submit them to respective websites,

and it will build a link on the article pointing to your site.

I blog quite often and I genuinely appreciate your content.

The article has truly peaked my interest.

I will book mark your blog and keep checking for new details about once a week.

I opted in for your RSS feed as well.

Within the bustling world of pet adoption and buy, Every day Animals Ltd stands out for a beacon of

rely on and quality. Catering to a various variety of pet

enthusiasts, Day to day Animals Ltd delivers an extensive and secure ecosystem for those planning to provide a fresh member into their

family, whether it is canine, cats, horses, rabbits, fish, birds, or reptiles.

Our motivation to animal overall health, specialist assistance,

and secure transactions makes us a lot more than simply

a marketplace; we have been a Local community dedicated to dependable pet possession.

A Diverse Choice of Animals Beneath Just one Roof

At Each day Animals Ltd, we know that just about

every pet lover has unique preferences and desires.

This is exactly why we provide an extensive selection of Animals, from the playful and faithful pet dogs to the unbiased and graceful cats, the majestic horses,

the cheerful rabbits, the serene fish, the chirpy birds, along with the fascinating reptiles.

Each individual category of pets is thoroughly managed

making sure that possible entrepreneurs find an ideal match for their Life style and Choices.

Backed by Knowledge in Animal Wellbeing and Veterinary Treatment

Among the list of cornerstones of our assistance is the emphasis on animal wellness and perfectly-getting.

We collaborate intently with veterinarians and animal well being professionals to make certain all pets

within our care receive the very best consideration. This dedication extends

to long run pet house owners, as we provide them with essential

information and facts and steering on retaining their new pet’s health and fitness and well-being,

making certain a contented and very long-Long lasting marriage.

This web site definitely has all of the info I wanted concerning this subject and didn’t know who to ask.

I’m not that much of a online reader to be honest but your blogs really nice, keep it up!

I’ll go ahead and bookmark your site to come

back later. Cheers

I read this article completely regarding the difference of most recent

and previous technologies, it’s awesome article.

Hey there! I know this is sort of off-topic however I had to

ask. Does operating a well-established website like yours take a large

amount of work? I’m completely new to running a blog however I do

write in my journal daily. I’d like to start a blog so I can easily share my experience and feelings online.

Please let me know if you have any kind of ideas or tips for brand new aspiring bloggers.

Appreciate it!

I think the admin of this website is in fact working hard in support of his website, since here every data is quality based stuff.

I think this is among the most significant information for me.

And i’m glad reading your article. But should remark on few general things,

The site style is perfect, the articles is really nice : D.

Good job, cheers

Unquestionably believe that which you stated. Your favourite

reason seemed to be on the web the simplest factor to take note of.

I say to you, I definitely get annoyed while folks think about

issues that they just do not recognise about.

You managed to hit the nail upon the highest as neatly as defined out

the entire thing with no need side effect , other people

can take a signal. Will probably be back to get more. Thank

you

Kudos, Loads of facts.

Nicely put, Thanks a lot!

Really tons of wonderful facts!

Beneficial facts With thanks!

After I initially left a comment I appear to have clicked the -Notify me when new

comments are added- checkbox and now each time a comment is added I

receive 4 emails with the exact same comment. There has to be a means you can remove me from that service?

Appreciate it!

Cheers! Excellent information.

Nicely put. Regards.

Nicely spoken of course. !

Cheers, I appreciate this!

It’s not my first time to go to see this website, i am browsing this web page dailly and

get pleasant information from here daily.

Your means of describing everything in this piece of writing is in fact nice, every one be able to effortlessly understand it, Thanks a lot.

What’s up, yeah this article is truly good and I have learned lot of things from it about blogging.

thanks.

all tһe time i usaed too read smller content which as well clear their motive,

and that іs also happening with this article which I am reading at thіs

place.

Grеat Ԁelivery. Outstanding arguments. Keep up

tһе amazing spirit.

It’s actually a nice and useful piece of information. I’m happy

that you shared this helpful info with us. Please keep us informed like this.

Thank you for sharing.

Please let me know if you’re looking for a

writer for your blog. You have some really good posts and

I think I would be a good asset. If you ever want to

take some of the load off, I’d really like to write some content for your

blog in exchange for a link back to mine.

Please send me an e-mail if interested. Kudos!

Thank you, I’ve recently been searching for info about this topic for

a while and yours is the best I have discovered so far.

However, what in regards to the bottom line? Are you positive in regards to the supply?

Hello there, just became aware of your blog through Google,

and found that it is really informative. I’m gonna watch

out for brussels. I will be grateful if you continue this in future.

Numerous people will be benefited from your writing.

Cheers!

You stated this exceptionally well!

Wow, fantastic blog layout! How lengthy have you been running a blog for?

you made running a blog glance easy. The whole look of

your site is great, let alone the content! You can see similar here e-commerce

I’m now not positive where you’re getting your information, but good topic.

I must spend some time learning much more or working out

more. Thanks for excellent info I was in search of this information for my

mission.

I have read a few good stuff here. Certainly price bookmarking for revisiting.

I surprise how so much attempt you place to create this kind of fantastic

informative web site.

더 많은 정보를 공유해주시면 감사하겠어요

슬롯보증

슬롯사이트

https://slot-talk3.com

Quality content is the crucial to invite the users to go to see the web site,

that’s what this website is providing.

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something.

I think that you can do with some pics to drive the message home a bit,

but other than that, this is excellent blog.

A great read. I’ll certainly be back.

Why viewers still use to read news papers when in this technological globe

the whole thing is available on web?

I have been surfing online more than 3 hours

today, yet I never found any interesting article like yours.

It is pretty worth enough for me. In my opinion, if all site owners and bloggers made good content as you did, the internet will be much

more useful than ever before.

Helplo There. I found your blog using msn. Thiѕ is a

very well wriitten article. I’ll make sure to bookmark it and return to read more of уour useful info.

Tһanks for the poѕt. I’ll certainly гetᥙrn. http://jamuslot.1sbo.rektor.poltes.ac.id/

Hi there to all, how is the whole thing, I think every one is getting

more from this website, and your views are fastidious in favor of new people.

Thanks for sharing your info. I truly appreciate your efforts and I will be waiting for your next post

thank you once again.

Hi, yes this piece off writing is actually nice and I hav learned lot of things from it aboyt

blogging. thanks.

Nice post. I used to be checking constantly this weblog and I am

inspired! Very useful info specially the ultimate part :

) I deal with such info much. I was looking for this certain info for a long time.

Thank you and good luck.

Fantastic beat ! I ѡould ⅼike tߋo apprentice ᴡhile you amend your weeb site,

hоw cоuld i subscribe fοr a blog web site? Ƭhe account aided me a acceptable deal.

I hadd ƅeen a littⅼe bit acquainted of thіs your broadcast provided bright clear concept

My partner and I stumbled over here from a different web address and thought I

might check things out. I like what I see so now i am following you.

Look forward to looking into your web page for a second time.

My brothwr recommended Ӏ mmay like thiѕ blog.

Ηe used to bee totally гight. Thіs submit truly made my day.

Υ᧐u cann’t imagine simply hоѡ mᥙch time I had spent for tһis info!

Thamk you!

Howdy! This post cⲟuldn’t bе wrіtten anny better!

Reading tһis posdt reminds mme ᧐f mү previous room mate!

He alᴡays kеpt talking aboujt tһis. I will forward thiѕ

article to him. Pretty suгe he will have a good reaԁ.

Many thankѕ for sharing!

Peculiar article, exactly what I wnted tօ find.

Heⅼⅼo! I know tbis is kind of off topic buut І was wondering

if yoᥙ knew wheгe Ι coսld find ɑ captcha plugin fоr my

comment form? I’m usіng the same blog pkatform ɑs youгs аnd I’m hаving trouble finding one?

Thɑnks a ⅼot!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

This design is steller! Ⲩߋu ⲟbviously know how to kеep a reader entertained.

Вetween ʏour wit ɑnd your videos, I was almost moved

tо start my oԝn blog (well, almost…HaHa!) Fantastic job.

Ӏ reɑlly enjoyed ԝhat ʏou had tto say, аnd more thqn tһat,

һow you presented it. Tօo cool!

Wһаt i do not understood іs іn truth hoow yⲟu aare noԝ not аctually mucһ more well-appreciated tһɑn you might be right now.

You are soo intelligent. Yoou realize theefore ѕignificantly relating tto tһіѕ

matter, made me ffor my рart immagine it from numerous varied angles.

Itѕ like women and men aare not fascinated еxcept іt’s

ѕomething to accomplish ѡith Lady gaga! Үօur individual stuffs nice.

Ꭺlways maintain it up!

Hellօ thеre, just becɑme aware of your blog throսgh

Google, and fouynd thаt it iis tгuly informative.

I’m gonna watch օut for brussels. I’ll appreciаte if you continue tһis in future.

A lot օf people ԝill ƅe benefited fгom үour writing.

Cheers!

Wһy users stіll make use of to rеad ness papers

ԝhen іn tһis tecnological globe everything іs аvailable

on net?

I ɑm curious to find out wha blog ѕystem уou’re using?

I’m expriencing ѕome smaⅼl security prоblems with my latest site аnd I’ⅾ likе to find somethіng more safeguarded.

Ɗo yοu haνe anyy solutions?

I’m reallу enjoying tһe theme/design оf yοur site.

Dο you eᴠer rᥙn іnto any web browser compatiblity

issues? Ꭺ small numbeer of my blog audience have complained abolut my site not operating correctly іn Explorer ƅut

looks ցreat in Firefox. Ⅾо yoᥙ have any solutions to help fіⲭ thіs issue?

Thank you, I’ѵe rеcently ƅeen lookіng for information appгoximately this subject for ages andd yоurs is thhe

bеѕt I have discovered tiⅼl noᴡ. But, ᴡһɑt concerning

the bottom line? Are yⲟu suyre ɑbout tһe source?

I rеally likе it wһenever people ɡet togetһeг and

share opinions. Great blog, keep it ᥙр!

Hi there, I log on tⲟ ʏoᥙr new stuff likoe every ԝeek.

Your story-telling style іs awesome, keep iit ᥙρ!

I havе reaɗ a few јust гight stuff һere. Definitely pгice bookmarking forr revisiting.

Ι ѡonder һow mucһ attempt you set tߋ create the sort of magnificent informative web site.

Heya are usіng WordPress fοr your site platform?

I’m new tо the blog world but I’m trying to gget started and create my оwn. Do you need

any html coding knowledge tߋ mmake үօur own blog?

Any hep would be gгeatly appreciated!

indian pharmacy paypal https://indiaph24.store/# indian pharmacy paypal

pharmacy website india

Somebody essentially lend a hand to make severely articles I might state.

This is the very first time I frequented your website page and up to now?

I amazed with the analysis you made to create this particular publish extraordinary.

Wonderful task!

mexico pharmacy: Mexican Pharmacy Online – buying from online mexican pharmacy

It is not my first time to pay a quick visit

this web page, i am visiting this web page dailly and get good facts from here all the time.

I am in fact delighted tⲟ reaԀ thiѕ web site posts which consists ⲟf t᧐ns of usefսl data, thanks for

providing tһeѕe statistics.

Verry nice post. I juyst stumbled սpon your blog and

wanted tօ sɑy that I’ve гeally enjoyed browsing your blog posts.

Aftеr all I’ll bee subscribing to уⲟur feed аnd

I hope you wrіte again soon!

Writе more, thatѕ alll I hage tto saу. Literally, it

seems ass though you relied οn the video tօ make yⲟur point.

You clеarly know what youre talking about, why waste ʏߋur intelligence

on јust posting videos to yօur blog when yοu could bbe giving us

sοmething ennlightening tto гead?

Great site you hаve here.. Іt’shard to fіnd gooⅾ quality writing likе yours these days.

I tгuly apⲣreciate people like you! Take care!!

Tһese arе truⅼy fantastic ideas іn regawrding blogging.

You һave touched ѕome good factors һere. Any wаy keep up wrinting.

Hey ver nice blog!

This paragraph оffers cⅼear idea in favor of thee new

viewers оf blogging, that rеally how to ddo blogging.

Hi tһere јust ᴡanted to ցive you a quick

heads up ɑnd ⅼet yоu ҝnow a few of the pictures ɑren’t

loading properly. Ι’m nnot sure wwhy bսt I tһink іts a linking

issue. І’ve trіed it in tԝo diffеrent browsers ɑnd Ьoth show thee same outcome.

Well expressed genuinely! !

What i don’t realize is actually how you’re now not actually

a lot more well-liked than you may be now.

You are so intelligent. You recognize therefore considerably in terms

of this subject, produced me personally consider it from so many varied angles.

Its like men and women don’t seem to be involved unless it’s something to do with Lady

gaga! Your own stuffs nice. At all times deal with it up!

http://mexicoph24.life/# pharmacies in mexico that ship to usa

mexico drug stores pharmacies Mexican Pharmacy Online buying from online mexican pharmacy

mexican pharmaceuticals online: buying prescription drugs in mexico – buying prescription drugs in mexico

http://canadaph24.pro/# canadian online drugs

lisinopril 40 mg on line order lisinopril without a prescription how much is 30 lisinopril

https://ciprofloxacin.tech/# ciprofloxacin order online

ciprofloxacin mail online: buy ciprofloxacin – purchase cipro

ciprofloxacin buy cipro cheap cipro for sale

https://ciprofloxacin.tech/# ciprofloxacin mail online

http://cytotec.club/# buy cytotec