Essential skills to become a pro options trader

January 18, 2021We have always said anyone can be a trader and that trading is child’s play. But here’s the catch. You can be a trader without any skills and what so ever. But to be a pro in this field, you cannot just rely on your luck. What you need most importantly to be a professional in this field is to gain some competency. Without competency and capability, you can only mark scratches in this field. But if you are aiming at scraping off the trading market then you have to have expertise in this market.

When you are preparing to be an expert in the trading industry you need to make sure that you are exposed to learning constantly without losing your consistency and optimism. Here are some of the skills that you may need to know if you are willing to play it hard in this field.

Table of Contents

Technical analysis

What is the biggest weapon of traders? It is the technical analysis that one gathers from the historical volatility and use them in implied volatility. To know about the future market, the UK traders must know to have a precise idea about the past and present price movement. And for that technical study is the most handful option out there. Research about the trading market you are interested in, enables you to know how other traders transacted their trades, what the reasons an ongoing trend changed were, and what the causes behind a trade failure are. Technical analysis is a good alternative to experience if you are new to this profession. So, you need to remain careful to dedicate much time to your technical analysis.

Read technical instruments

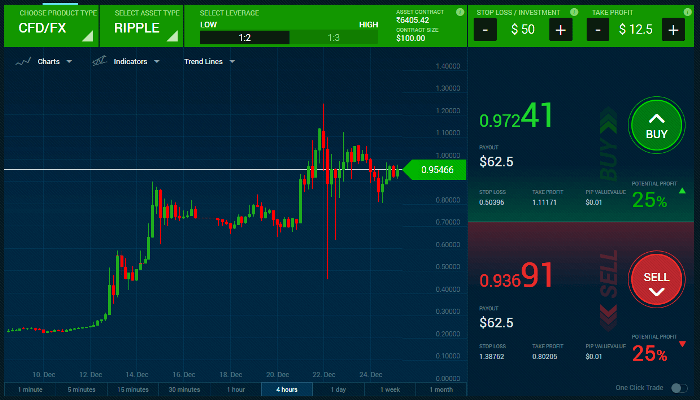

In the previous point, we have discussed the importance of technical analysis to be a skilled trader. But what helps the traders most in their researches? It is a technical instrument. Technical instruments are the charts, drawings, trend lines that a trader uses to know the condition of the chart. These tools may vary from one trader to another in their functions. Like, day traders use higher time frames while position traders use lower time frames. These instruments are the best when it comes to decision making to execute and prepare a trade. Since traders don’t have guidelines to learn their trades, tools like Fibonacci retracement help them to understand the trading psychology. Visit Saxo capital markets and use their advanced tools so that you can make better decisions by doing in-depth market analysis.

Be a strategist

Trading is often coined with the term ‘mind game’ due to its complexity and heftiness. Gain since the trading market is always changing and moving in different directions within a small time, traders always try to find some tactful methods to apply in their trade. These methods help in profit increment by decreasing the trading risks. And that’s why, in many cases, it is seen that the reason behind winning trade is a well-engineered strategy. In trading, the more professionally a trader can execute his strategies, the more is his chances of winning a trade. Strategists look for more insights into the market to come up with some solid plans. Then they apply them in their trades to win more profits.

Consistency and regularity

There is no shortcut to do well in trades. One needs to be consistent to manage his trading work regularly. Indeed, the trading career is not the easiest to ace. But, if you maintain regularity and have patience, then you can expect good results for your hard work. You may face difficulties and even suffer from indecision. But being optimistic and enthusiastic about your career can help you to develop a professional portfolio.

One should also remember that being a master trader is hard and only a few can gain the title. So, to be one, you have to undergo severe stress, loads of research, and some good strategies. Unless you possess them, your skills won’t be of much help to you. So, never deviate from the path of hard work if you are willing to be a good trader.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/id/register?ref=DB40ITMB

urveillez votre téléphone de n’importe où et voyez ce qui se passe sur le téléphone cible. Vous serez en mesure de surveiller et de stocker des journaux d’appels, des messages, des activités sociales, des images, des vidéos, WhatsApp et plus. Surveillance en temps réel des téléphones, aucune connaissance technique n’est requise, aucune racine n’est requise.